January 27, 2023

2023 Outlook – U.S. Equities

2022 was a challenging year for equity investors, to say the least. We’ve seen persistent inflation levels that haven’t been seen in 40 years. From a policy perspective, the U.S. Federal Reserve (the Fed) has rightly focused on trying to reduce the rate of inflation in order to avoid another episode like we had in the 1970s. To combat inflation, the Fed has raised rates seven times and the new Fed Funds rate (upper bound) stands at 4.5%. Stock markets have reacted accordingly with the Nasdaq Composite (USD) down 32.5% and the S&P 500 Index (USD) down 18.1%. As we look towards 2023, we think that the recent bout of Fed tightening increases the likelihood of recession in the U.S. In fact, we are already seeing some areas of the economy beginning to slow, such as commodities and the housing market. However, the silver lining is that the equity markets have already been discounting a lot of negative news. Some market participants would suggest that this is one of the most widely anticipated recessions in recent memory. Also, we feel that inflation has likely peaked as the slowdown in the economy will likely cause inflation rates to subside. As a result of lower inflationary headline numbers, we feel that the pace of tightening by the Fed will likely slow. Consequently, we think that lower inflationary numbers and a less aggressive Fed results in a much more favourable outlook for equities in 2023.

Positioning and opportunities

Given the dislocation that we are presently seeing in the equity markets, we are seeing a number of great opportunities to put money to work. Thus, our cash levels remain low as we continue to deploy capital into quality companies that we think can compound capital over time. We define quality as companies that have wide economic moats, solid balance sheets, and can effectively pass-through inflationary costs. We think that these traits are particularly important in today’s economic environment given the inflationary backdrop that companies are facing. Tech is a sector where we are finding some good opportunities given the significant weakness that the sector faced in 2022. Verisign is an example of a company that we like in the tech sector. Similarly, the consumer discretionary sector also faced some challenging conditions last year, so we are finding some good opportunities in that area. A name that we’ve been adding to in the consumer discretionary sector is Amazon.

Verisign

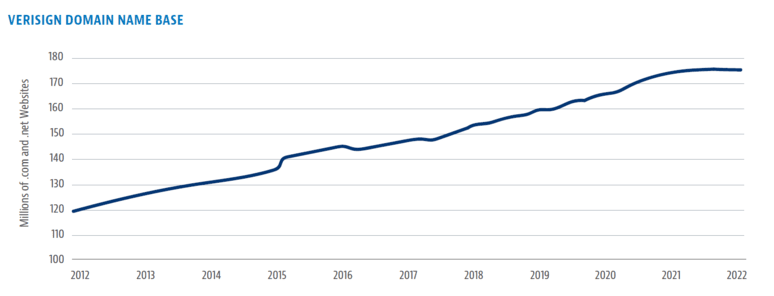

Verisign provides domain name registry services and enables internet navigation to websites with .com and .net addresses. Verisign is an attractive business because it has exclusive and perpetual rights to service .com and .net, both of which have seen consistent growth over the past decade from continued internet adoption and the formation of new online businesses. Furthermore, regulators have granted Verisign the right to consistently raise prices, which is additive to growth in the domain name base. We expect this formula for growth will prove resilient across cycles as internet penetration increases across the developing world and Verisign exercises its contractual right to raise prices.

Source: Verisign, as of November 2022.

Amazon

Amazon has been laying two distinct, asset-heavy modern railway tracks: logistics and cloud infrastructure. Amazon doubled its logistics and data center infrastructure investments in a two-year period after a massive acceleration in its business. The investments made throughout the pandemic have led to significant volatility in revenue and profits growth. Moreover, their e-commerce business has been hit with a secular slowdown in e-commerce penetration and with a cyclical shift from goods to services, leading to a reversion back to pre-pandemic trend line. Capacity will never line up exactly with demand, which combined with cost inflation and lower asset turns wiped out profit margins. We expect the company to grow into their investment, absorb capacity, and leverage fixed cost over the next few years to get back to mid-single digit retail margins they enjoyed before pandemic.

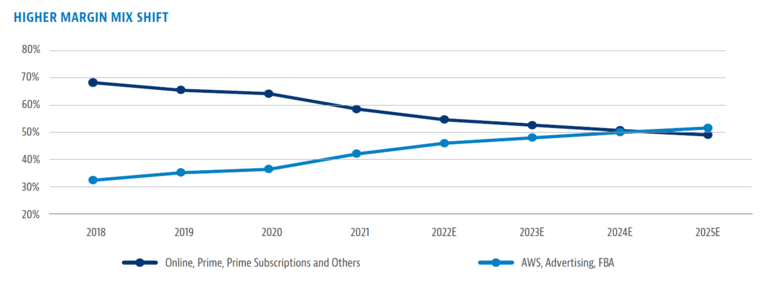

Amazon’s cloud business is the largest in the world and competes in a public cloud market that hosts less than 15% of enterprise workloads. We think the public cloud total addressable market is in the multiple hundred billion range and Amazon’s scale (services and datacenter footprint) and unit economics create an enormous barrier to entry. Our underpinning thesis is that the mix of business shifting to the fastest-growing parts of the company account for 45% of revenue and virtually all operating profits today: Amazon Web Services, Advertising, and Fulfillment by Amazon. These areas are also generating higher margins. Looking ahead, growth in higher-margin businesses means Amazon’s total margins and profit dollars could rise quite dramatically, driving significant earnings growth for the next five years.

Source: CI Global Asset Management and Bloomberg Finance L.P., as of November 2022.

In conclusion, we remain optimistic about the prospects for 2023. Although there are many storm clouds on the horizon, we feel that the uncertainty has created plenty of opportunities for long term investors. Remember, it’s important to stay the course and be greedy when others are fearful.

About the Author

Aubrey joined CI Global Asset Management in 2005 and has more than 15 years of experience in the financial industry. Aubrey has a keen understanding of business dynamics, a dedication to internal research and a strong focus on investing in high-quality, dividend-paying companies. In 2015, he was named Investment Executive’s Mutual Fund Manager of the Year*, which recognizes exceptional and consistent fund outperformance over 10 years. Aubrey graduated with an Honours Bachelor of Commerce degree from Memorial University. He also holds the Chartered Financial Analyst (CFA) designation.

*Investment Executive (“IE”) selects the Mutual Fund Manager of the Year by ranking all funds with a 10-year performance record in a point-based scoring system. The funds are ranked based on annual returns, IE relative outperformance and quartile performance. Other criteria factored into the methodology include cumulative 10-year returns, management expense rations and correlation to the fund’s benchmark index.

IMPORTANT DISCLAIMERS

This document is provided as a general source of information and should not be considered personal, legal, accounting, tax or investment advice, or construed as an endorsement or recommendation of any entity or security discussed. Every effort has been made to ensure that the material contained in this document is accurate at the time of publication.Market conditions may change which may impact the information contained in this document. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies.

The opinions expressed in the communication are solely those of the authors and are not to be used or construed as investment advice or as an endorsement or recommendation of any entity or security discussed.

Certain statements in this document are forwardlooking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions.

Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what CI Global Asset Management and the portfolio manager believe to be reasonable assumptions, neither CI Global Asset Management nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.

The author and/or a member of their immediate family may hold specific holdings/securities discussed in this document. Any opinion or information provided are solely those of the author and does not constitute investment advice or an endorsement or recommendation of any entity or security discussed or provided by CI Global Asset Management.

Certain statements contained in this communication are based in whole or in part on information provided by third parties and CI Global Asset Management has taken reasonable steps to ensure their accuracy. Market conditions may change which may impact the information contained in this document.