January 24, 2023

Strategies to Minimize Downside Volatility

Investing is a way to achieve your future financial goals. Whether you’re saving to send your children to college, purchase a future property, or fund the retirement of your dreams. To achieve your goals faster, the best approach is to stay invested over the long term. However, this can take a great deal of discipline and patience.

In times of market turbulence, many investors struggle to stay the course. As people watch their bottom-line drop, it’s tempting to sell and get out before things get worse. While it’s common knowledge that investments rise and fall, extreme market volatility can trigger fear. This can cause investors to overestimate potential losses and pull out. Unfortunately, if you sell too soon, you risk reduced returns.

If you don’t want to deal with the extreme ups and downs of a volatile market, and you’re ready for a smoother ride -- you have options!

A minimum volatility strategy can help you to stay the course.

What is minimum volatility investing?

A minimum volatility (min vol.) strategy invests in low-volatility stocks and avoids those with high volatility. The goal of this strategy is to participate in up markets while protecting against the down markets.

With a low volatility approach, you may have to forgo some upside when markets rise. However, you can rest easy knowing your capital is preserved in down markets. Given the unstable market environment of 2022, many investors are turning to minimum volatility strategies.

The benefits of minimum volatility investing

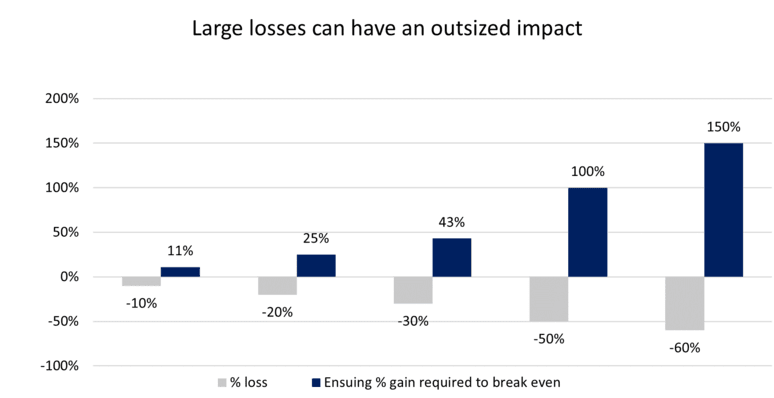

Negative returns can dramatically impact portfolio performance. Portfolios that experience significant losses face the increasingly difficult task to reach break-even. Trying to reduce downside risk can result in more favorable returns over time and can provide a smoother investment experience overall.

Source: CI Global Asset Management

Giving up some of the risk doesn’t mean your returns will suffer. Contrary to conventional wisdom, research has observed that lower volatility stocks have historically been able to deliver better risk-adjusted returns than higher risk stocks over the long run.1, 2

This is often referred to as the “low volatility anomaly” or “low volatility effect.” Because a low volatility security falls less in down markets, this allows more capital to grow when markets rise again, leading to faster recoveries and the potential to generate outperformance through the power of compounding. This is not just a phenomenon observed in current North American markets. It’s an anomaly that has been observed and documented globally for decades.3

Our minimum volatility ETFs

The CI Minimum Downside Volatility Index ETF suite includes the CI Global Minimum Downside Volatility Index ETF and the CI U.S. Minimum Downside Volatility Index ETF. These ETFs seek to provide effective and differentiated exposure to the low volatility factors, investing in low-volatility stocks which typically fall less than other stocks in down markets.

Unlike traditional minimum volatility strategies that tend to focus on total volatility, CI’s minimum volatility suite aims to target downside volatility to minimize risk from negative returns through its robust index methodology.

Are you ready for a smoother ride?

If you’re looking for a less volatile investing experience that offers downside protection while also generating similar, if not superior, risk-adjusted returns, consider a minimum downside volatility ETF.

For more information about our ETF strategies, visit our ETF solutions page.

References

1 Financial Analysts Journal. (2018). Benchmarks as Limits to Arbitrage: Understanding the Low Volatility Anomaly.

2 The Journal of Portfolio Management. (2020). The Volatility Effect Revisited.

3 S&P Global. (2019). Is the Low Volatility Anomaly Universal?

Glossary of terms

Volatility: Measures how much the price of a security, derivative, or index fluctuates. The most commonly used measure of volatility when it comes to investment funds is standard deviation.

Return (risk-adjusted): A measure of investment performance taking into consideration how much risk/volatility was assumed to generate it. Consider two investments, both of which return 10% over a given time period. The investment with the greater risk-adjusted return would be the one that experienced less price fluctuation. Two of the most commonly used measures of risk adjusted returns are Sharpe and Sortino ratios.

About the Author

As Vice-President, Head of ETF Strategy, Nirujan’s primary responsibility includes working with the various departments within CI GAM to set and execute the ETF Sales Strategy and help promote the growth of the ETF business. Nirujan’s responsibilities also includes overseeing the ETF Sales Support team where he works alongside the sales team in assisting investors and advisors on ETF education and support. Nirujan brings a wealth of ETF knowledge, including ETF product management, indexing, factor research, ETF portfolio development, and has been involved in the launch of many ETFs in the Canadian marketplace. Prior to joining CI GAM, Nirujan held progressively senior roles with global asset managers Invesco and Horizons ETFs, where responsibilities included product management, product development and sales strategy in both the Canadian and U.S market. Nirujan holds a Bachelor of Commerce (Finance and Accounting) from Ryerson University and is a CFA Charterholder.

IMPORTANT DISCLAIMERS

Commissions, management fees and expenses all may be associated with an investment in exchange-traded funds (ETFs). You will usually pay brokerage fees to your dealer if you purchase or sell units of an ETF on recognized Canadian exchanges. If the units are purchased or sold on these Canadian exchanges, investors may pay more than the current net asset value when buying units of the ETF and may receive less than the current net asset value when selling them. Please read the prospectus before investing. Important information about an exchange-traded fund is contained in its prospectus. ETFs are not guaranteed; their values change frequently, and past performance may not be repeated.

This document is provided as a general source of information and should not be considered personal, legal, accounting, tax or investment advice, or construed as an endorsement or recommendation of any entity or security discussed. Every effort has been made to ensure that the material contained in this document is accurate at the time of publication. Market conditions may change which may impact the information contained in this document. All charts and illustrations in this document are for illustrative purposes only. They are not intended to predict or project investment results. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies.